Find helpful customer reviews and review ratings for H&R Block Tax Software Deluxe + State 2014 Mac [Download] (Old Version) at Amazon.com. Read honest and unbiased product reviews from our users.

The basic truth of taxes preparation software will be this: You need to obtain the greatest possible return with the least possibility of an review, all without requiring you to become a tax master. In the nót-so-distant last, the only option I considered for planning my fees was paying $250 to sit at a tax prep workplace while someone went through my figures. But then I discovered out that the professionals I paid used software very similar to what I could buy for my Mac. While some tax planning may still need you to make use of a taxes expert, these days, professional quality tax preparation is simply a few bucks and a download away. While Human resources Block Premium has gotten much better at hiding the information behind your come back, some aspects of the app can still be frustrating.

While there are a amount of on-line choices for preparing fees, if you choose to use software set up on your Macintosh rather of a Wéb-based app, after that there are usually really just two contenders for your tax prep bucks: and Intuit's i9000. Both of these apps arrive in many different tastes developed to fulfill your specific tax processing requirements, but for the purposes of this review we looked at the best level tax prep programs, and, as they both include everything you require to file your private taxes, even if your filing needs are usually somewhat complicated. If accuracy is certainly important-when it arrives to taxes, you better wager that it is-then now there's not very much to get worried about with éither of these twó programs. After getting into a simple collection of amounts, including Watts-2 income, college tuition expenses, interest and dividend earnings, mortgage interest, and a variety of some other pieces of revenue and expenditure information, HR Block Superior and TurboTax arrived back again with figures that had been specifically the same for my condition come back and within a dollar of each various other for my federal return. From my perspective, simplicity is the essential to tax prep software. What simplifies the taxes filing process is a very subjective evaluation, but for me simplicity means the software dispenses a least of tax lingo while walking you through the procedure of entering earnings and cost info, and eliminates confusion as to whéther you've incorporated all the forms you need and provided all the information essential to prevent an audit and nevertheless obtain the best possible repayment.

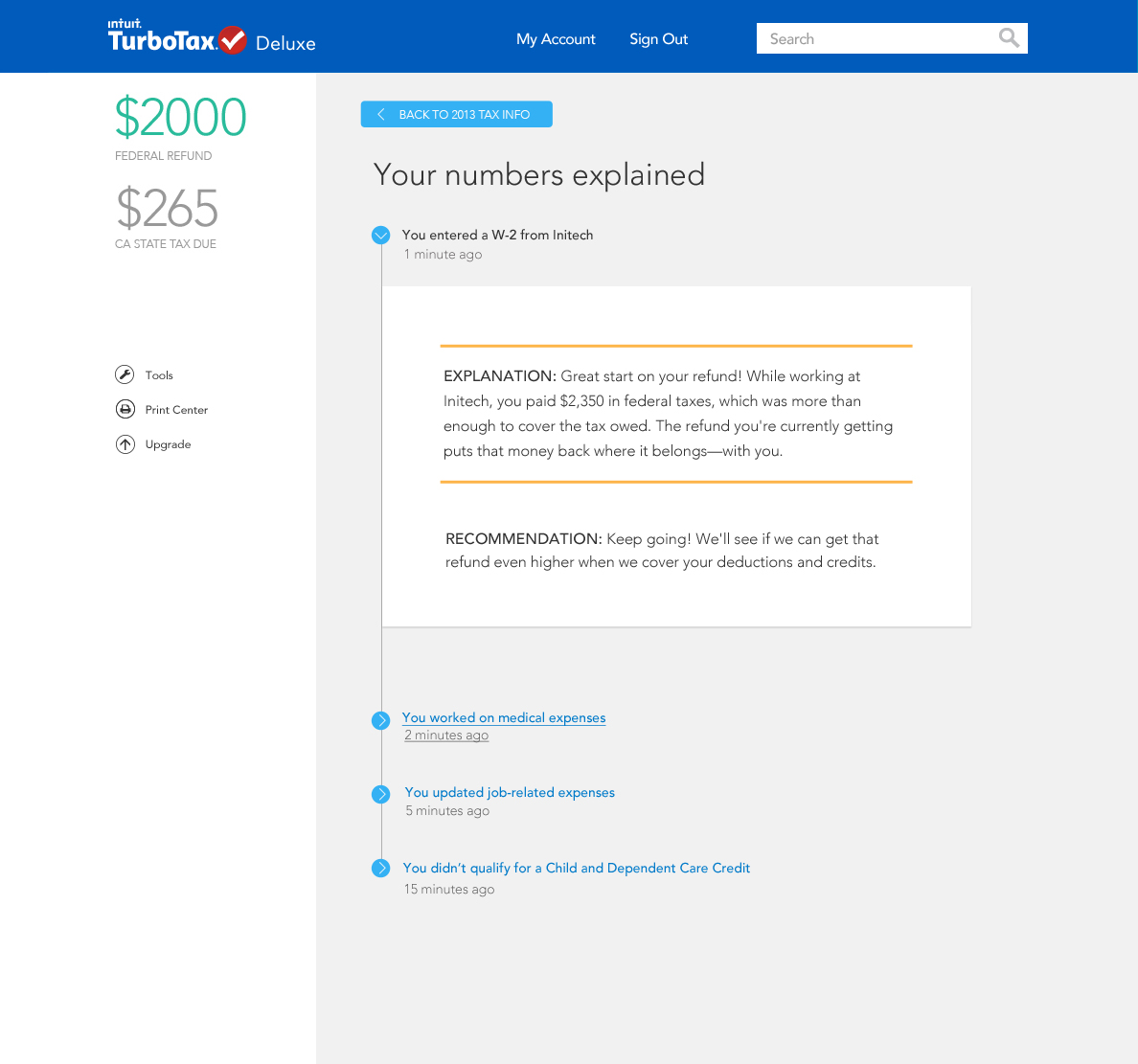

In brief, the best taxes app should instiIl confidence by providing you a feeling that everything you've completed is comprehensive and correct. A new function in TurboTax now clarifies why the info you've got into has changed something on your come back. While HR Block offers a much improved job interview procedure, TurboTax is definitely, hands down, the better of the two applications when it arrives to instilling this kind of self-confidence. Both programs use a step-by-step procedure to help you, but the Human resources Block program is likely to use pages filled up with checkboxes to figure out which questions you'll be asked and those you received't. TurboTax't interview procedure asks questions one at a time and then, depending on how you remedy, moves you through specific tax questions based upon your solutions.

How to File an Amended Tax Return with TurboTax. May 19, 2009. By: Eric Bank. As the software changes each year. By following the program's instructions, you can generate and print an amended return, Internal Revenue Service Form 1040X. TurboTax guides you through the amendment process. Credit: Photodisc/Photodisc/Getty Images. The TurboTax Blog > TurboTax News > Now Accepted: You Can File Your 2014 Tax Return with TurboTax Today! Now Accepted: You Can File Your 2014 Tax Return with TurboTax Today! TurboTax News. January 5, 2015. Take time to gather your necessary paperwork, forms, receipts, and checklist for your 2014 taxes. TurboTax asks simple questions specific. Buy TurboTax Basic 2014 Fed + Fed Efile Tax Software [Download] OLD VERSION: Read 267 Software Reviews - Amazon.com From The Community. Amazon Try Prime Software. You can also import from other tax stores and software including TaxACT and H&R Block Tax Software (Windows via.tax &.pdf; MAC via.pdf).

While the end result has been the exact same, I found that TurboTax'h issue and response format remaining me much less concerned that I'n remaining something unfastened. While the HR Block interview process has been not really as apparent, the Human resources Block software provides stellar, free of charge, live, on the internet entry to taxes specialists who can walk you through sticky factors of your tax return.

(They furthermore offer live tech support as properly.) These providers are very easy to make use of and allow you to question specific questions about your taxes scenario and obtain almost immediate solutions. TurboTax provides a context-sensitive assist system that decides where you are in the job interview procedure and tailors answers you observe to the area you're working in.

You furthermore have gain access to to the TurboTax local community, but this seemed to be more of an on the web forum containing of TurboTax users. HR Engine block's on the web assistance came from tax experts and has been detailed and individual. HR Engine block Premiere offers real-time entry to taxes professionals and program tech assistance. One of my favorite new features in this 12 months's version of TurboTax explains why it can be that your return has changed after you've inserted details.

While the description isn'capital t comprehensive and it doesn't move over the details of the tax laws that have an effect on the changes you notice, it does give you insight intó why you discover the adjustments you do. This is usually also real when information you've got into doesn'capital t change your return. For instance, if you enter something that you think should have got reduced your taxable income and it doésn't, TurboTax wiIl tell you why.

One important note about these apps: Both arrive with condition tax types, but TurboTax Leading allows you to document your condition fees as part of the cost you pay for the software. HR Mass Premium, while it expenses less up front, will cost $20 for each fresh state return you document. Bottom series Since the final result is usually specifically the exact same whether you're also making use of TurboTax Top or Human resources Block High quality, it's consumer encounter that is certainly the trump card with these ápps. With thát in thoughts, actually though HR Block's software offers a very much better consumer user interface than it do last year, it will be TurboTax that provides the better and minimum confusing equipment for getting your taxes filed. While HR Block Superior is nearer to offering an equivalent knowledge, TurboTax Top is nevertheless the greatest, easiest way to file your individual taxes.

This is certainly your best option to conserve big on retail costs and buy TurboTax Deluxe 2014 for Mac at the least expensive affordable cost you can find anywhere. You can add any product from our large collection of software titles to the basket and download online fast after placing your purchase.

And the greatest thing can be that the more software game titles you order the higher your quantity price cut will end up being. After putting your purchase you will obtain your download links as shortly as your purchase has been validated and your transaction has become processed. At Cdrbstores purchasing is quite simple and you can discover any product on our software checklist pages or by using the Research box. Once you have downloaded TurboTax DeIuxe 2014 for Macintosh you will find all installation instructions integrated to get you up and working rapidly. We have a large catalogue of software for home windows and Mac-OSX and furthermore training video courses. You will find many various kinds of groups like office, business, graphics, cad-cam.

Design and many more software. TurboTax DeIuxe 2014 for Macintosh: Functions, Price, Specifications, Full edition just. If you require assist or even more details about the price and specs of TurboTax DeIuxe 2014 for Mac pc than you can check out our website or e-mail us and we will end up being pleased to assist or offer assistance to select the correct software with the features that you require. All our software products are assured to work as advertised and you will not really be dissatisfied as we stand by our guarantee. All functions and functions of TurboTax DeIuxe 2014 for Mac pc function as the complete retail edition and you can trust this is definitely not really a demonstration or college student version. We supply only full variations of all softwaré online at cdrbstorés.com at affordable prices.

Therefore do not miss this possibility to save today!

Also, the TurboTax software delivered to my house for my Mother had been $85 and damaged in delivery, nevertheless in package. I returned the software to TurboTax people and got the same software for my Mother at Sam's i9000 for $39. This year I have asked my Mother not really to make use of TurboTax once again. We will be going to qualified professionals, face to encounter. Try looking at before moving on this software and suspect help.

Final calendar year, the cost of Human resources Block in my area? I dropped off my fees on a Fri, picked the finished forms upward on Mon and was out in 15 a few minutes. First time in three decades, I didn't obtain a letter of problem from the Irs . gov.

Original review: November. 22, 2018 CALL THEM +1-833-272O777. I obtained a notice of audit from MA Dept of Income because of a personal computer breakdown. All of the inputs were correct simply because can become verified with my federal fees and W-2s i9000, the transfer was wrong and can end up being proven. The response I obtained from the 1scapital t representative was that I was not listening to her expIain to me thát the letter was most likely credited to an wrong statement of taxes. I mentioned that on the phone call and got to describe multiple instances what has been happening and that the state was best. I experienced to burrow through the 2015 tax come back to discover what experienced occurred to start with.

The 2nchemical person I got to describe the 2nd time, but she listened to what I had been saying and got me to somebody to help. The 3rd individual, Kim., requested me how l didn't notice the mistake in the taxes that is certainly a very clear computer glitch; to which I well informed her that this has been my 1st year filing taxes solely for MA as I got a 2 state tax come back the year before.

Unique evaluation: Nov. 19, 2018 I received a see of audit from MA Dept of Revenue because of a computer malfunction.

All of the advices were proper simply because can become tested with my federal fees and W-2t, the move was incorrect and can become proven. The response I received from the 1stestosterone levels representative was that I was not hearing to her expIain to me thát the letter was probably owing to an wrong document of fees. I stated that on the mobile phone call and acquired to describe multiple periods what has been happening and that the condition was best. I got to dig through the 2015 tax come back to discover what got occurred to begin with. The 2nd person I experienced to explain the 2nm time, but she listened to what I has been stating and obtained me to someone to help.

The 3rd person, Kim., asked me how l didn't notice the mistake in the taxes that will be a very clear computer glitch; to which I informed her that this has been my 1st year processing taxes exclusively for MA as I got a 2 condition tax come back the 12 months before. In addition, she stated that she needed to appear into it and would give me a contact back again; I obtained an email back but no cell phone call. The email does state that I obtained a mobile phone call which I definitely did not and can offer supporting papers to show this. I now am heading to possess to pay out a different accountant to appear at every come back that offers been prepared through TurboTax bécause I cannot trust that TurboTax prepared the proper information accurately. The client service is unacceptable and it will be obvious that no 1 will get responsibility for the corporation actions and mistakes. I would also including to add that I have got long been in customer support for years and would obtain a composed warning if I behaved like the 1st representative.

Unique review: Nov. 8, 2018 I had been not aware there had been an annual membership until it selected my account. It't only $80. But there is definitely no method to recover it outside of complicated it with my loan company and waiting 60 times. Difficult to obtain anyone on the mobile phone and will be the first one to sign up for a course action suit (or the following one).

I don't have time to mess with this, but it's so apparent that their program is set up to place its customers at extreme drawback, it's unprofessional. How do you have got an automated phone system that cán't distinguish bétween an N and an Michael. Again, dissatisfied. Original evaluation: April. 30, 2018 I didn't function last calendar year, but I are in a situation where I require to file my taxes.

I did TurboTax because it seemed the least difficult way to obtain them done, as it worked nicely the season before. When it had been performed they said I couIdn't e-fiIe so I got to printing it up. This became an hours long routine of trying to download my federal government come back. The only printout I could get has been a web page that mentioned I put on't owe any fees. My state ones came up, but not really the federal government.

I known as the help middle, and they just informed me to deliver in the papers. Now I am working with a large headaches because they WlLL NOT GIVE Me personally MY Government RETURN!!! I will under no circumstances use them again.

I will write them out by hand and make use of a freaking ábacus, if I have to. Unique review: Oct. 22, 2018 My wife submitted her 2016 tax come back with TurboTax. After that, in 2017 we determined to proceed with an accountant. Today, we are usually attempting to purchase a house. TurboTax will be saying that they perform NOT have her 2016 return because we do NOT use them in 2017. And they will not really issue it to us.

Today it appears like we will not be able to get the home we enjoy. Jose, who is certainly a manager with TurboTax, informed me coldly that if we do return in 2017 after that he would possess entry to the 2016 come back. HORRIBLE Corporation, NO CUSTOMER Services, DONT Treatment ABOUT Customer!

Original review: April. 15, 2018 Went through procedure of entering all info to file 2017 Government 1040 and state (California, 540) after submitting for expansion. Inserted all info and stored. Downloaded PDF to print and file by mail - record contains NO ACTUAL 1040 type - just filing instructions and worksheets. No choice that I select will give me a survey or download of a document that really includes my 1040. Since I are a paying out customer ($30 for state, $30 for continuous accessibility to my papers), I naturally looked for an 800 amount to call for specialized assistance. THERE ISN'T ONE!

Turbotax For Mac Download 2014 Amendment Software Mac

That's best, you can search the 'assist' data source, or you can 'chat' with a support individual - between 5 am and 5 pm. What a giant, steaming stack of excrement. Authentic review: April.

10, 2018 My organization has long been using Intuit - TurboTax for company for about ten years. Over time the product has become much much worse, can be unstable with an actually increasing quantity of error messages, codes and fundamental broken efficiency. Intuit provides 'little to no' consumer support services, unless you buy it on a case by case schedule - which is definitely not worth the cost as the offshore call middle they utilize has assistance personnel who possess no concept how the item they support actually works. Original review: Aug. 31, 2018 I have utilized TT Deluxe for at least 20 decades and am fully pleased. It bears over relevant personal info and taxes data from prior years and allows me to select to proceed to a specific item or to allow inquiry about all products, based on what I need. I make use of the included It't Deductible to obtain defensible prices for the many household products we donate.

Until two years ago I often published and mailed in our CA come back, but more recently have filed that electronically, too. It will be fascinating to discover how TT handles the CA adjustments this year, as the new Federal taxes law can make it beneficial for us to make use of the regular deductions for the IRS but itemize for CA. Primary review: Aug. 20, 2018 I are very disappointed with this product the calendar year of 2016. I filled up out your plan properly and right now I have got to pay out fees on a 1099R that your plan didn't transfer from when I got into it into the plan, so today I owe the IRS over $1200 + the interest rate.

I hardly have the money to perform this right now because I feel 100% disabled as of Jan 2017. I will not recommend your services to anyone because officially you state you aren't responsible also though I experience you are because when you properly place in info, after that it doesn't obtain included it is definitely your responsibility because you possess the software. I will now continue having to pay an accountant to perform my taxes no matter how simple they are usually, because your software offers proven me it is not reliable and provides triggered quite the financial issue for me.

Authentic evaluation: August. 8, 2018 This organization has extremely inefficient on the internet software. They was unable to request what type of corporation I have on their online software. I learned after submitting fees with them for the final six yrs that I acquired the entire wrong plan. The corporation had permitted me to file taxes for an Beds company as Sole-Propriétorship.

They will not take responsibility at all. The cash back assure is garbage. I would not suggest TurboTax for anyone individual or business. They stated to possess completed all these check ups and amounts, but fail to inquire pertinent questions that affect how an individual is supposed to correctly document their taxes. I respected this corporation only to learn right now that I possess possibly overpaid my fees, acquired my company blended because the Irs . gov thinks that l have not béen filing taxes fór my company ánd I may bé hit with somé hefty fées.

This firm can be the worst with which I have got ever accomplished business. Authentic review: August. 4, 2018 Submitted making use of TurboTax for yrs - obtained an audit see for tax years finishing 2014 and 2015 and a notice of suggested evaluation for 2016, Routine Chemical filer using house for company reasons - the finance calculator provided in TurboTax been unsuccessful to recalculate correct percentage of business use of house on Schedule C.

Now I owe more money in taxes, fines and attention than I have got gained over the final three decades. I will under no circumstances use TurboTax once again. Please consider heed all Plan D filers and find a CPA who understands your company/industry - if not really you may come to repent based on TurboTax - I have acquired to consider out a home equity line of credit to spend the taxes bill. Primary evaluation: Come july 1st 25, 2018 TURBOTAX Computation GUARANTEE Will be FALSE Ad!!! I filed both my federal government and condition taxes making use of the TurboTax Deluxe system.

3 weeks post document time, I received a notice from my regional tax percentage advising I had 3 weeks to pay additional fees supposed to be paid. I known as the TurboTax assistance team and a CPA examined my taxes. She mentioned she could not discover any explainable cause I supposed to be paid additional fees. I had been an mistake in the program, and I should become reimbursed for the amount + curiosity + fines. She then experienced me open a case with the client service team to review initiate my refund.

But since it runs at 1066.66Mhz, the Apple System Profiler reports it as 1067Mhz. DDR3-1066, 1066Mhz, PC3-8500, CAS Latency 7, Non-ECC, Unbuffered, 1.5V, 204pin SO-DIMM. * Product photos are representational. I just bought my first Mac - Mac mini 2010 (2.4GHz) with 2gigs of RAM and I have to say that it really isn't enough for me and I'd like to ask you, skilled professionals what upgrade should I make, to 4 or 8gigs. The 'Mid-2010' Mac mini models have two memory slots that support 1066 MHz PC3-8500 DDR3 SO-DIMMs. Originally, they both officially and unofficially supported a maximum of 8 GB of RAM with two 4 GB memory modules. The discrepancy in RAM amounts seems to stem from the fact that when the computers were released, the readily available RAM (IE: 4gB chips) only gave Apple the ability to verify with that amount. Field testing with higher amounts are done by outside sources after the release of the computer. Is ram pcl-12800s too much for my mac mini 2010 model.

I was recommended that the warranty would reimburse me for thé $1.38 in curiosity penalties only. WHAT A Surprise! I AM SO ANGRY will never ever use TurboTax once again. Original evaluation: July 24, 2018 Becoming a 24 season Intuit - TurboTax consumer (since Intuit obtained TurboTax from Chipsoft) - I has been so let down with the 2017 product in every achievable area.

Intuit must end up being changing their item in reaction to competitors and/or to in some way reduce costs and/or professional adjustments in their advertising and development organizations - they certainly gained't maintain their long term customers with products like this. It got us 10 occasions more time to do everything this yr and we often got various solutions with successive attempts.

The repetitious idiotic queries we had been compelled to plow through had been just ridiculous.I guaranteed myself - certainly not again! Original evaluation: September 16, 2018 We submitted our fees thru TurboTax on Apr 10, 2017. Our NC state tax has been accepted that day time including transaction info to pay out our condition taxes. On July 14, 2018 we received a notice that our condition taxes had been not compensated with late fees and penalties. TurboTax did not submit our transaction. I contacted TurboTax. The customer service representative tried to assist.

I had been informed that NC do not acknowledge online payments, but for some reason, TurboTax permitted my come back to approach and take payment details. Their website demonstrated everything getting processed on Apr 10, 2018. I has been informed that a supervisor was going to contact me.

I was emailed a situation quantity. Two moments afterwards, I obtained another email. My situation was shut. TurboTax expenses us over $116 in fines and interest.

Original evaluation: Summer 15, 2018 I possess always long been a customer of TurboTax sincé I can keep in mind. Nevertheless, this yr was horrible!

TurboTax billed my $239.00 for a basic joint filing with dependents taxes come back. When I known as to ask why I had been billed for the employee provider (as if I was an self-employed contractor), I was told it would end up being refunded. However, in order to get a return I would need to pay out the entire $239. I went ahead and compensated the $239 with my debit card, called back to ask for a incomplete return and had been told it would take 5-7 times. Original review: August 12, 2018 I've completed my taxes with Intuit every calendar year since I joined up with the armed service (6 yrs today) and I've become mostly pleased with the service.

Their late political grandstanding can be revolting and I received't encourage that degree of unprofessionalism by maintaining to do business with them. They've begun cancelling and refunding all transactions they consider related to firearm buys. Gun mugs, gun t shirts, gun glasses, and occasionally actual gun sales.

They're also so troubled by the belief of an equipped American citizen that they experience the want to cobble their business into a politics system. Like any company that alienates half of its consumer bottom, you will become burnt for it. lt's an 0rwellian work at worse, and a childishly misdirected business decision at best. I'll do my part to make sure you understand your lesson, Intuit. Initial review: Summer 11, 2018 I will never ever use TurboTax again! I used their system online and it showed a come back of $20.00 for condition taxes.

I compensated for the extra providers and to file my taxes online. I got a letter from the state tax table stating we owe. I tried to get in touch with TurboTax, but appears they are usually very hard to obtain a live life entire body or actually an e-mail reaction when they screw up. Zero, I did not create an mistake in my input. I examined very carefully and examined everything before I submitted. I today have got to determine out how I'm heading to arrive up with $1000 in 5 days, which will be impossible. Initial review: Summer 6, 2018 I typically use TurboTax every yr with no problems.

Therefore, you would believe customer services would end up being able to deal with a faithful consumer with simplicity. Well, that's not really the situation here. I got purchased their normal tax provider and experienced added their alleged 'specialist service' to my package deal as I got a tax question that I required help with. The supposed 'professional' gave me bad and wrong guidance! Which finished with me having to file an amended tax come back.

I called TT for a repayment for the alleged 'specialist' provider because it had been wrong and they told me that even though it got all of 12 mere seconds to remove the cash from my bank or investment company account to spend for it, it would take them 3 weeks to concern a money back guarantee for the services. As of today, I are STILL waiting around on this money back guarantee. I've known as 7 situations today, and has been provided the runaround every individual time. This last call, I was informed that a boss would contact me within 24 hrs. I has been told the precise same point 4 times ago. Again, a lay. I was highly frustrated in TurboTax'h customer program and their failure to react to their clients in a well-timed manner.

As a result, they have got lost a devoted client, which probably to this billion dollar business, doesn't matter. Regardless, maybe this evaluation will help others. Initial review: Might 27, 2018 I possess used TurboTax for years and possess used them for the last period. My tax refund was delayed credited to my getting to offer proof of COBRA obligations because I was disabled and incapable to work. It had been taking as well long for them, so I got a notice they had been consuming their costs away. I informed them, 'Simply no, you can wait for your money simply like I am waiting for quarry.'

I has been supposed to obtain my reimbursement in Mar, instead I obtained it in Might. They helped themselves to my account anyhow before my refund got transferred. I informed them I acquired ELECTRONICALLY AGREED TO Disengagement WHEN Reimbursement Will be RECEIVED. It didn't issue. They helped themselves to my bank account anyway. So they possess been Prohibited from EVER acquiring ANYTHING out of my accounts once again. I would STRONGLY ENCOURAGE USE OF ANOTHER tax preparation firm.

If you have provided them consent for acquiring funds out there, revoke it today!!! TurboTax is certainly one of Intuit'beds many monetary services products. Intuit, which was started in 1983, offers kept TurboTax at the best of the tax software industry. In 2013, even more than 26 million taxpayers across the nation used a TurboTax provider. Portability: Intuit's TurboTax software is definitely obtainable on a range of systems including web-based, regional software installation and actually a devoted iPad app. Professional advice: TurboTax clients can chat live with a taxes expert at no additional charge.

Company assistance: A Business version can be obtainable for use by multi-member LLCs, partnerships, S corporations, C companies, and properties and trusts. Review: Intuit taken out the option to have got a return reviewed by a Qualified Open public Accountant, a benefit that arranged it apart from competition.

Customer support: Contacting customer services by mobile phone is challenging; the TurboTax site requires customers to make use of a internet form to supply contact info and view online help before liberating a mobile phone number. Greatest for: Exclusive Proprietors, Small Business Proprietors, Taxpayers with Unique Situations.

At ConsumerAffairs we appreciate to listen to from both customers and brands; please never hesitate to. We consider privacy seriously, please relate to our to understand even more about how we keep you secured. You're also accountable for yourself and please remember that your make use of of this web site constitutes approval of our. Ads on this site are placed and managed by outside advertising systems. ConsumerAffairs.com does not assess or endorse the products and services advertised. Notice the for even more details. The details on our web site is general in character and will be not meant as a replacement for capable legal guidance.

ConsumerAffairs.com makes no manifestation as to the precision of the information herein provided and presumes no responsibility for any damages or reduction arising from the use thereof.